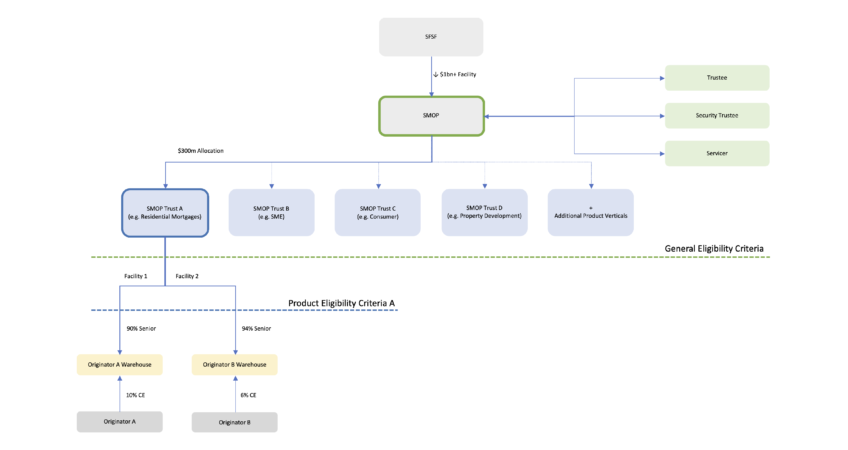

Small and Medium sized Originators (SMOs) are sub scale when it comes to accessing the Structured Finance Support Fund (SFSF). By aggregating the funding requirements of multiple SMOs through the Small & Medium Originator Programme (SMOP) the SFSF would be able to efficiently deploy >$1bn of liquidity support to a portfolio of SMOs, while enforcing robust downstream credit management and governance.

Critically, this does not require cross-collateralisation of individual SMO loan books and allows for tailored private-sector funded first loss credit enhancement in each warehouse.

You are using a non-registered version of TNC FlipBook - PDF viewer for WordPress. Please register your copy of TNC FlipBook - PDF viewer for WordPress to receive updates & keep using without issues.Click Here to go to registration page.

To register your interest and receive updates, enter your contact details below: