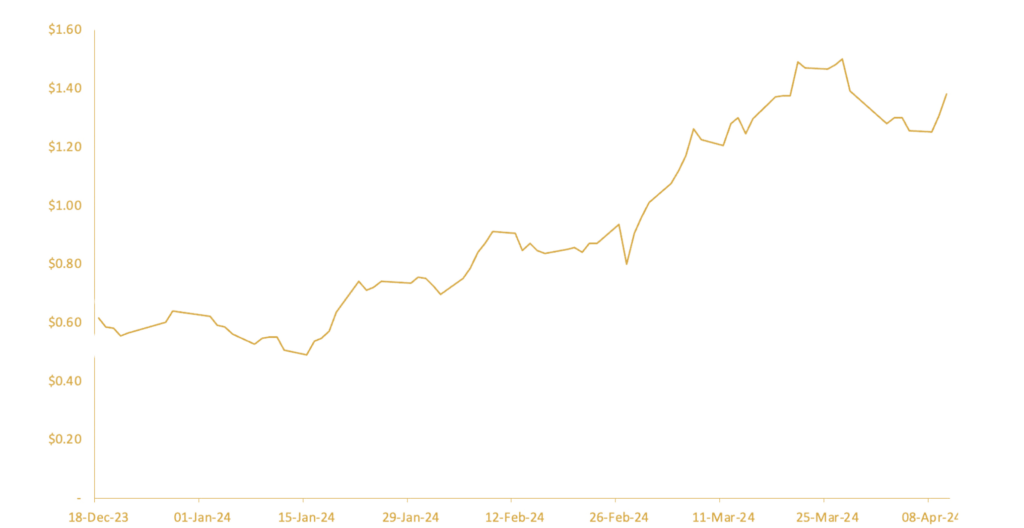

Neu Capital acted as the sole debt advisor to Zip Co (ASX: ZIP) on their A$150m facility with Ares Management Corporation (“Ares”). This facility fully refinanced a significant maturing liability with healthy tenor and headroom, underpinning Zip’s balance sheet strength and growth ambitions. Market confidence drastically improved, with Zip stock rising 100%+ post announcement.

Zip Co, a leading digital financial services company, is a global interest-free ‘buy now pay later’ service with operations based in Australia, New Zealand and the USA. It provides consumers and merchants worldwide with access to transparent and flexible credit options, with thousands of retailers offering Zip as a payment choice to their customers.

The corporate facility was part of a range of financing initiatives unveiled by Zip to clean up its capital structure after market sentiment softened on the sector.