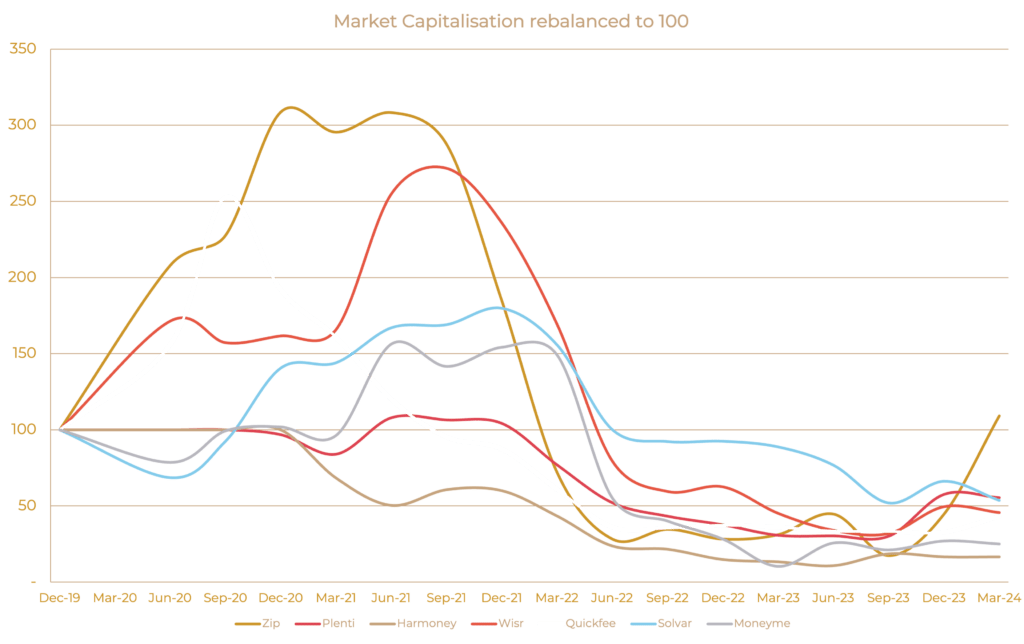

The nuclear winter of equity valuations for non-bank lenders has continued. The valuation boom over 2020 and 2021 has been followed by two years of equity market malaise. Expectations of rate cuts and lower than expected loss rates has started to create some green shoots, but the key to winning back the equity market is to demonstrate profitable growth without the requirement for further equity raises. The emergence of OpCo lending solutions solves this for many originators.

In 2020 and 2021 equity markets were rewarding lenders based on their growth rates using a % of TAM (Total Addressable Market) valuation. Originators were encouraged to pursue a market share capture strategy that put short term profitability as a deeply secondary consideration.

Then 2022 hit and lenders were faced with rapidly rising base rates. BBSW went from 0.1% as at April 2022 to over 4% a little over a year later. For lenders who were reliant on fixed fee income or who had fixed lending rates, this meant significant margin compression. But less directly it created an expectation of rising loss rates. Non-bank originators were already perceived to be operating in asset classes with borrowers that were below bank standards, so any expectation of higher losses was predicted to be focused on this non-bank sector. Although these loss rates didn’t really eventuate, it did result in funding margins going up as banks who provided warehouse financing reduced their exposures and credit funds increased their margins on mezzanine notes.

The main shift, however, was one of perception. The equity markets decided that lenders needed to become profitable… NOW.

This posed a problem for lenders given they operate on a primarily fixed cost base and need to scale their book in order to hit profitability. Increasing book size requires a first loss/ equity contribution on the net growth in their loan book meaning that even if they become profitable, it may not be sufficient to support their own growth, thereby needing a further equity type solution. The equity markets began to resemble traditional bankers, favouring companies already financially secure and only giving their money to companies who didn’t need it. Loan originators requiring a pipeline of future equity raises became unsettling for the market given the potential dilution involved.

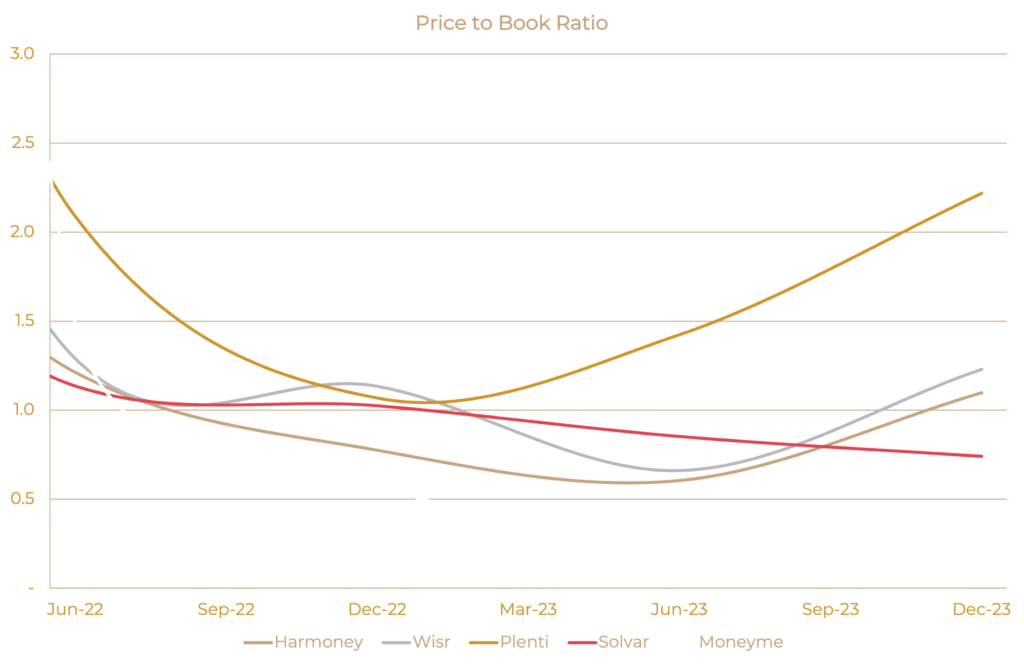

These low valuations on listed ASX non-bank lenders, had a flow on impact on the private market as public valuations are used as benchmarks for private company raises. These low share prices are not just low relative to historical share prices, they are also extremely depressed relative to the book value of equity. Up until recently all the main non-resi-mortgage, non-bank originators were trading at below NTA (Net Tangible Assets). This meant that the dilutionary impact of equity raises was prohibitively high for non-bank lenders in a scale up/ pre-profitability phase. A share price below NTA, at an extreme signals that it would be in shareholders’ best interest for the business to be shut down and the loan book to be collected with net proceeds returned to shareholders.

The thaw in the nuclear winter of equity valuations should start to occur with interest rates stabilising, loss rates remaining low and funding costs reducing. But even if this winter continues, equity alternatives now exist with a range of funds providing OpCo debt solutions allowing lenders to release equity capital tied up in their existing book and fund growth without the need to go back to equity markets.

OpCo loans are loans provided to the originator/ servicer directly and sit outside the formal trust warehouse. They are typically secured against the equity slice in the warehouse / trust effectively increasing the advance rate toward 100%. This both releases equity and reduces the amount of equity required to fund book growth.

Good examples of OpCo solutions that NeuCapital have advised on is ZipCo and Wisr.