There has been much discussion in the AFR recently about the ASX 200 at near record highs and whether equity market valuations are stretched.

Many AFR readers will be unaware that private sector debt, the “distant relation” of the financial markets family, is also experiencing bull market conditions.

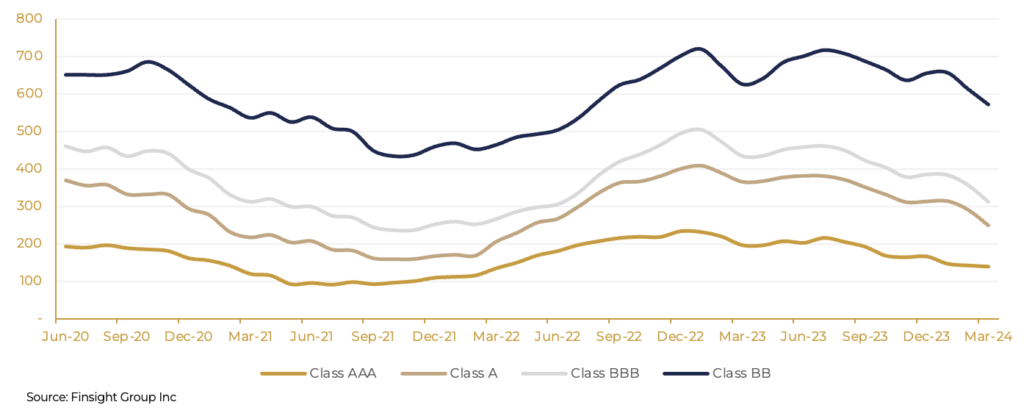

Credit spreads on rated asset backed securities issued in the Australian market are approaching their COVID level lows. The graph below demonstrates the margin (credit spread) on AAA, A, BBB and BB rated notes above the benchmark bank bill rate (BBSW) since June 2020.

APAC Historical Credit Spreads – 3-month Rolling Average

From Q3 2020, as the concerns about the impact of Covid dissipated as the medical solution became more evident, spreads began to rally (reduce). Combined with the extraordinary liquidity provided by central banks globally, this led to extremely strong demand for credit products, leading to credit spreads falling to post-GFC lows. As an example, banks in Australia were provided with a funding line from the RBA at a cost of 0.10% and were able to invest this in AAA rated residential mortgage-backed securities at a yield of 1% or better.

From circa mid 2021, credit spreads reversed their downward movement and moved higher. Markets started to become concerned about inflation, the likelihood of higher rates and the impact of a hard economic landing on credit performance. Investors started to require a premium for this risk leading to higher credit spreads. Non-bank lenders were also witnessing higher demand for loans from borrowers, which led to them requiring more funding. As these lenders can’t raise deposits like a bank, this created a greater supply of securities.

In late 2022 / early 2023, after 18 months of moving higher in margin, credit spreads peaked, driven by two key factors.

Firstly, it became evident that the materially higher arrears rates and credit losses projected by market participants were not likely to occur. As the RBA has confirmed in its market correspondence, despite the dual headwinds of higher rates and the higher cost of living, the consumer has been more resilient to rate rises by virtue of their savings accumulated during Covid, the low unemployment rate and the ability to find additional or alternative work.

Secondly, the impact of higher base rates and wider credit spreads has led to very strong inflows into credit funds. Investors have been able to earn “equity like” returns from credit assets with much lower volatility (i.e. 7% plus returns with less likelihood of variance). This has led to strong demand for credit, notably from superannuation where both institutional and SMSF investors are allocating more of their monthly inflows to credit assets.

So where to from here?

Explaining history is easy, predicting the future is for the foolish or the brave. At the risk of being both, it’s likely that credit spreads will remain “well bid” for the foreseeable future due to a number of factors.

Firstly, base rates in Australia are likely to stay higher for longer, providing a solid pillar for credit returns. Even if the current RBA cash rate of 4.35% falls to 3%, it’s still a lot higher than the 1.5% pre-Covid level and 0.10% Covid low.

Secondly, the flow of funds into super will continue, buoyed by strong levels of employment, a higher contribution rate, the favourable tax regime and the reinvestment of earnings from assets in the accumulation phase.

Thirdly, the Australian economy is somewhat sheltered from large economic swings, with its large mining industry, permanent immigration inflows and offshore student numbers creating a sound economic foundation.

Fourthly, the ongoing demographics whereby more Australians are moving to the retirement phase will see more funds flow from equity allocations to less volatile asset classes like credit and property.

Finally, given high grade credit funds continue to produce higher returns (after fees) than bank deposits, but with effectively the same liquidity, more funds are likely to flow to these funds. Albeit the Financial Claims Scheme doesn’t apply to credit funds, investors in the retirement phase are willing to allocate more of their funds to higher yielding but relatively low risk assets. The growth in credit funds like Latrobe and Metrics, both with more than $15 billion in funds under management, is testament to the growth of credit funds and strong investor demand for yield.

Albeit the rise of the non-bank lenders will continue over time, they can’t create a supply side shock whereby the market is swamped with new issuance.

So, absent a black swan event from a known or unknown event which leads to materially lower base rates and/or materially worse consumer and business loan repayment behaviour, the hunt for yield will continue and the bull market in credit has further to run.